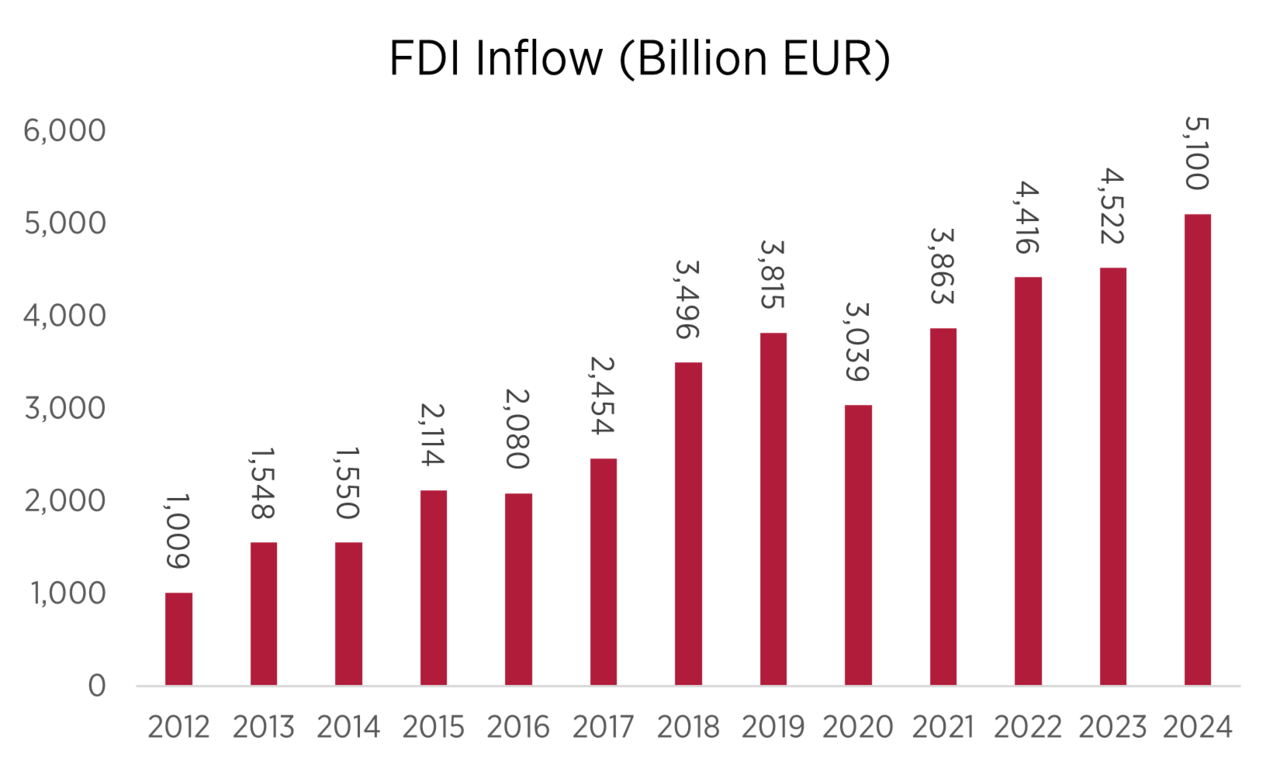

Serbia has been recognised as one of the fastest growing economies in Europe, a regional leader and part of the emerging market of the Western Balkans. In 2022, Belgrade was declared the city with the greatest economic potential in a competition of the 100 largest cities in the Emerging Europe region. For a number of years, Serbia has topped the global FDI performance index – rankings as the best investment destination on the globe.

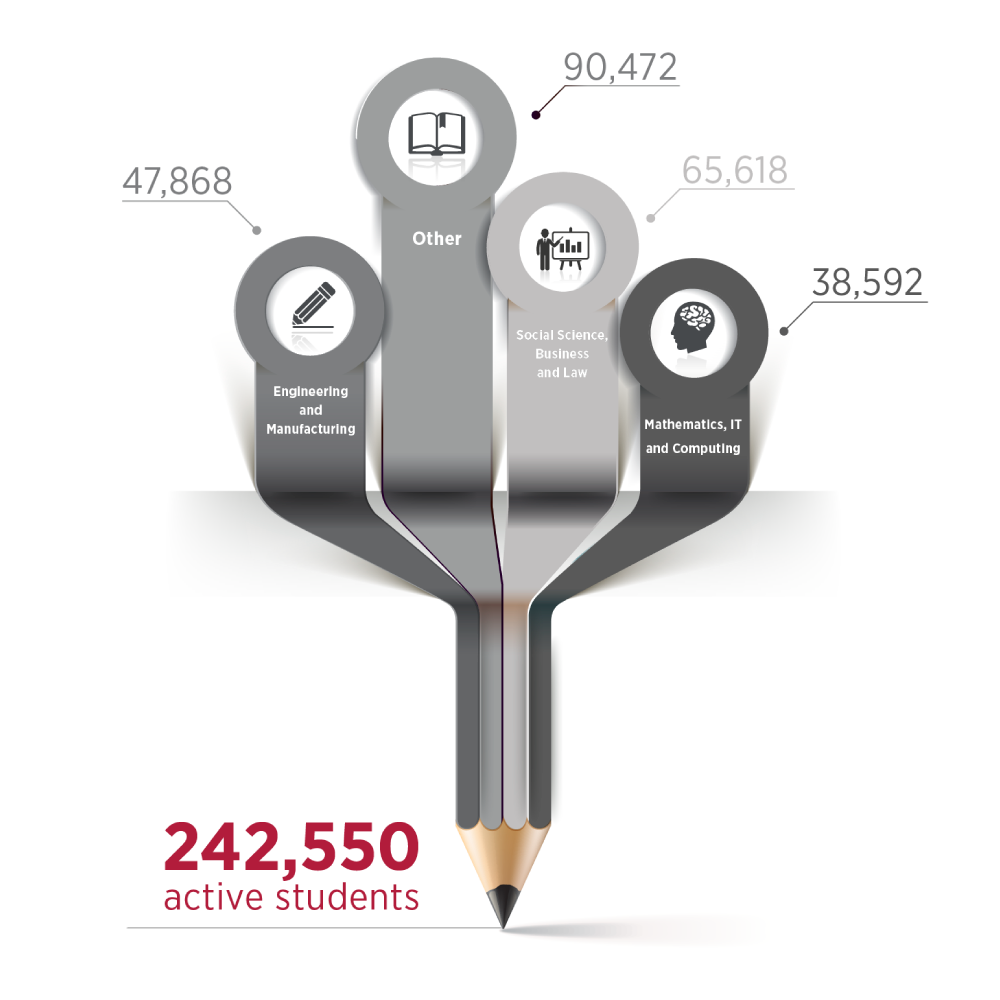

Continental, IMI, Bosch, ZF and Siemens have already recognized Serbia as a good investment destination for further development and research. Since 2003, universities and colleges in Serbia have produced about 47,500 graduates, 1,000 Masters of Science, and 400 PhDs annually.

The Western Balkans are also accelerating efforts to facilitate economic cooperation through the Open Balkan initiative. Plans to move forward with a legal framework have been recently revived, with the signing of three MoU’s in Skopje in July 2021, on the facilitation of imports, exports and the free movement of goods between the three countries; cooperation on creating free access to a common labor market

Externally, Serbia can serve as a manufacturing hub for duty-free exports to a market of more than 1.3 billion people that includes the European Union, the Eurasian Economic Union, USA, Japan, Australia, South East Europe, the European Free Trade Agreement members, and Turkey.

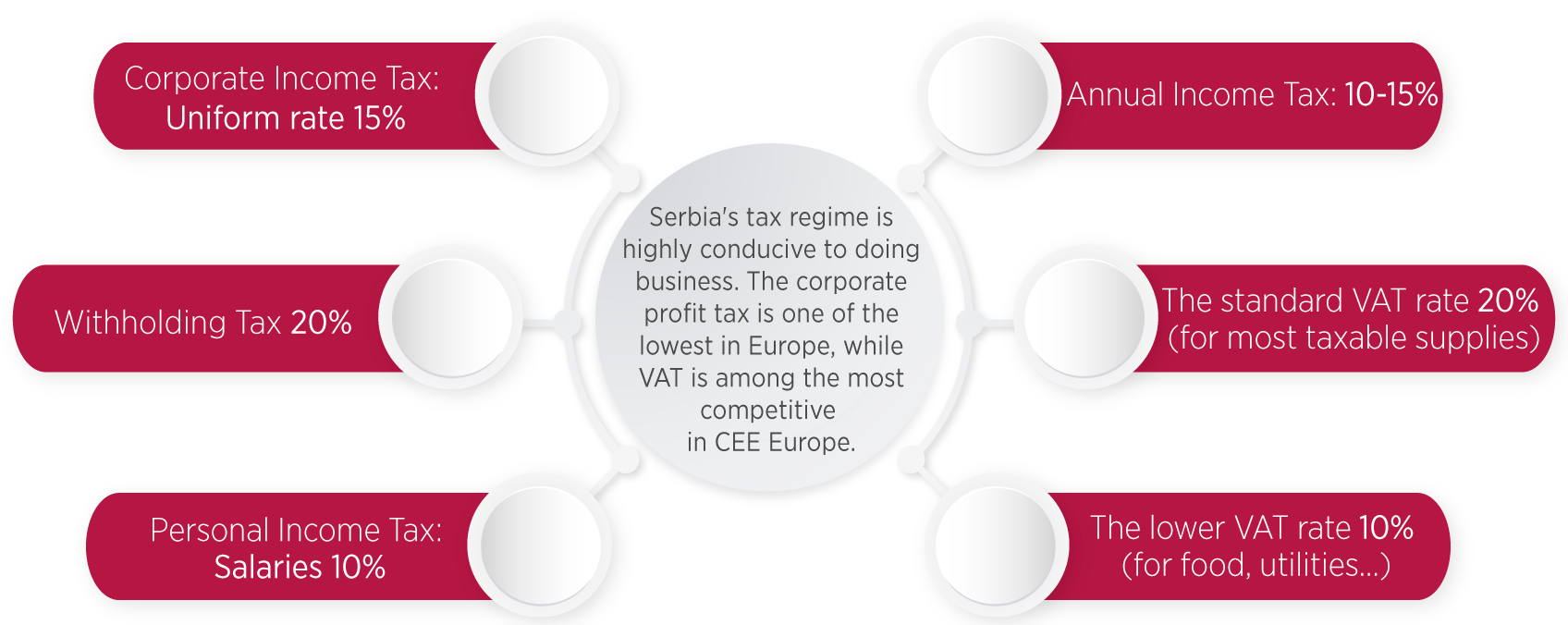

The Government or the local municipality can sell construction land at a price that is lower than the market price in support of an investment project that is of national importance (if the land is owned by the government). A 10-year Corporate Profit Tax Holiday is available for investors who hire more than 100 employees and invest more than 8.5 million euros. Tax holiday begins once the company starts making a profit.

Serbia and the Western Balkans are facing numerous challenges in their European integration processes, which, as an integral part, include national laws being constantly harmonized with the EU acquis communautaire. European Law, Trade & Enlargement team’s areas of expertise include antitrust/competition law, corporate law, privatization, regulatory compliance, trade and internal market rules, intellectual property rights legislation and regulation of financial services, litigation, M&A, state aid, trade policy negotiations and many others.

Trade regulation is one of the main areas that impact our clients’ business in Europe. The entire regional trade with the EU is regulated by a network of SAAs (Stabilization and Association Agreements), i.e. trade agreements that regulate the free movement of goods, services, and capital, freedom of establishment, and issues like competition protection and state aid control, which regulate day to day business of our clients, and which are enforced by national regulatory agencies. Meanwhile, the accession process and negotiations with the EU set the pace for rapid changes in national jurisdictions.

Imports from the EU is customs-free for most of the products. Some export limitations are imposed only on exports of baby beef, sugar, and wine in the form of annual export quotas.

EU-Serbia Stabilisation & Association Agreement

Industrial products exported from Serbia to EFTA member states (Switzerland, Norway, Iceland, and Liechtenstein) are exempted from paying customs duties, except for a very limited number of goods.

EFTA-Serbia Free Trade Agreement

Apart from facilitating tariff-free commerce among its member nations, the accord outlines the concept of accumulating product origin. This entails deeming items that Serbia exports as having Serbian origin if the constituent materials originate from any other CEFTA country, the European Union, Iceland, Norway, Switzerland (which includes Liechtenstein), or Turkey.

CEFTA-Serbia Free Trade Agreement

In 2019, the Republic of Albania, the Republic of North Macedonia, and the Republic of Serbia took the forefront in an effort to bolster the unrestricted flow of commodities, services, individuals, and financial resources, drawing inspiration from the EU framework. The Open Balkan initiative serves as a reinforcement to ongoing regional endeavors, aiding in their execution, and addressing the demands of the economy, businesses, and practical daily existence.

Open Balkan Access to Free Labor Agreement

The Free Trade Agreement between the Eurasian Economic Union and its Member States, on the one part, and the Republic of Serbia, on the other part, was signed on October 25, 2019, and entered into force on July 10, 2021.

Eurasian Economic Union-Serbia Free Trade Agreement

Companies from Serbia can export to Turkey without paying customs duties. Imports of industrial products from Turkey are generally customs-free.

Turkey-Serbia Free Trade Agreement

The Transport Community has 36 participants – the European Union member states, the six South East European Parties (the Republic of Albania, Bosnia and Herzegovina, Kosovo*, Montenegro, the Republic of North Macedonia, and the Republic of Serbia) and the three observing participants (Georgia, Republic of Moldova and Ukraine). The aim of the Treaty, therefore, is the creation of a Transport Community in the field of road, rail, inland waterway and maritime transport as well as the development of the transport network.

Transport Community Treaty

The organization was founded by the Treaty establishing the Energy Community signed in October 2005 in Athens, Greece, in force since July 2006. The key objective of the Energy Community is to extend the EU internal energy market rules and principles to countries in South East Europe, the Black Sea region and beyond on the basis of a legally binding framework. The Energy Community has nine Contracting Parties – Albania, Bosnia and Herzegovina, Kosovo*, North Macedonia, Georgia, Moldova, Montenegro, Serbia and Ukraine.

In accordance with the Multilateral Convention, which has been in force in Serbia since October 2018, amendments to the Double Taxation Treaty have already been made with numerous countries, and may have a significant impact on taxation. Taxpayers are often unaware of the new tax risks and opportunities that come with international taxation. Through detailed tax planning in international transactions, Gecić Law can assist taxpayers to optimize tax effects through the implementation of the Double Taxation Treaty and social conventions that Serbia has signed with other countries.

Gecić Law, widely recognized for its EU law, Banking & Finance and Corporate Practice, is proud to be one of the few law firms in the region with extensive experience and expertise to advise the public and private sectors on numerous particular and complex group of issues regarding investments in Serbia. For more information please contact our legal team who will assist you on further details.