Bogdan Gecić, the Founding Partner of Gecić Law, recently spoke with journalist Paddy Bolton. He was thereafter quoted in a Brussels Signal article regarding the EU’s Foreign Subsidies regulation (FSR) and its application in football. Spain’s top football division has filed a complaint with the European Commission (EC) against France’s Paris Saint-Germain (PSG). They argue that PSG’s funding from Qatar violates the EU’s rules on foreign subsidies. Similarly, Belgian football club Royal Excelsior Virton has raised objections about Lommel SK, which receives Abu Dhabi funds. The Foreign Subsidies Regulation (FSR) and Football These interventions come after the EU’s FSR came into […]

Details

As anticipated for some time in the previous months, while having been agreed upon between the EU institutions, the Foreign Subsidies Regulation (Regulation) finally saw the light of day on January 12, 2023. Its application will commence on July 12, 2023. The Regulation offers new tools for the European Commission (Commission) to investigate financial contributions from non-EU countries to companies operating in the EU to prevent distortions in the internal market. This specific State aid regime provides for an extended application of EU rules and the Commission’s competencies beyond the EU borders. One of the notable features is that the […]

Details

On December 9, 2021, the European Commission (’’Commission’’) approved Croatian State aid in the amount of EUR 783 million to support the production of electricity from renewable energy sources as part of the European Union’s endeavors to meet the climate and energy objectives set by the Communication ‘A policy framework for climate and energy in the period from 2020 to 2030’. The Croatian scheme will be open until 2023 and will be paid out to the selected beneficiaries for a period of 12 years. The Commission assessed this scheme under the 2014 Guidelines on State aid for environmental protection and […]

Details

The European Commission has proposed the prolongation of the State aid Temporary Framework until 30 June 2022, in order to expedite the ongoing Covid-19 economic recovery in Europe. The Temporary Framework was initially adopted on 19 March 2020 and to this date, it was amended and prolonged five times (more information available here and here). Margaret Vestager, the Executive Vice-President, who is in charge of the competition policy said that we are finally seeing improvements in the EU economy after the big crisis that hit the EU due to Covid-19. She also added: ’’[W]e need to be aware of disparities […]

Details

Here we go again, fighting climate change. This time, we are focusing on State aid and climate change, and discussing an important question – how green is State aid? Back in 2019, Europe ushered the European Green Deal. The European Commission published a Communication on the European Green Deal in its tenacious efforts to tackle climate change and other environmental challenges. This Communication is the EU’s attempt to work on the transition to a future where there will be no “bad emissions”, to put it plainly. If we were to get more technical, to create a Europe with net-zero emissions […]

Details

In the process of gradually aligning its legislation with the EU acquis the Government of the Republic of Serbia adopted two bylaws on 11 March 2021 in the field of state aid, complementary to the recently adopted new State Aid Control Act. All this adds value to the start of talks on the Chapter 8 – Competition Policy of Serbia’s negotiation process and may speed up Serbia’s EU accession. Regional Aid Regulation This regulation is designed to promote economic development of the least developed regions or the development of regions with a high level of unemployment. It also allows state […]

Details

Gecić Law is currently representing Bosnia and Herzegovina in a procedure with the Energy Community, a landmark case across the Balkans related to alleged state aid in the construction of Block 7 of the Tuzla Thermal Power Plant, a project worth USD 1.1 billion, with co-counsel Marić & Co. Law Firm based in Sarajevo. Launched in 2018 by the Secretariat of the Energy Community against Bosnia and Herzegovina, the process has been marked by violation of due process, complete disregard for the rights of the defense as well as continuous bids of the prosecution to speed up the process and […]

Details

Our Energy practice team has repeatedly demonstrated its credibility by devising unique opportunities for greenfield and brownfield investments for our clients. We provide comprehensive solutions related to privatization, regulatory compliance and due diligence in cooperation with eminent regulatory, corporate and financial experts. Counsel to Norwegian NBT AS on Wind Farms Project in Serbia Our latest accomplishment in the energy sector is providing counsel to NBT AS, Norway, a utility-scale wind power developer (exceeding 100 KW of power), in partnering with WV International (formerly Windvision). WV International has been developing wind farm projects in Serbia since 2010 and has been active […]

Details

Here we bring you a more detailed overview of the State aid package granted to Montenegro Airlines A.D. Podgorica, Montenegro’s national airline. We touched on the topic a few weeks ago. Introduction To recap, just days after announcing a EUR 133 million aid package for Montenegro Airlines the country’s national competition and state aid authority, the Protection of Competition Agency (“Agency“), launched an investigation into the State aid package. The Agency’s investigation found that the MEO test conditions had not been fulfilled, therefore qualifying this boost to Montenegro Airlines as State aid. On foot of that finding the Agency ordered […]

Details

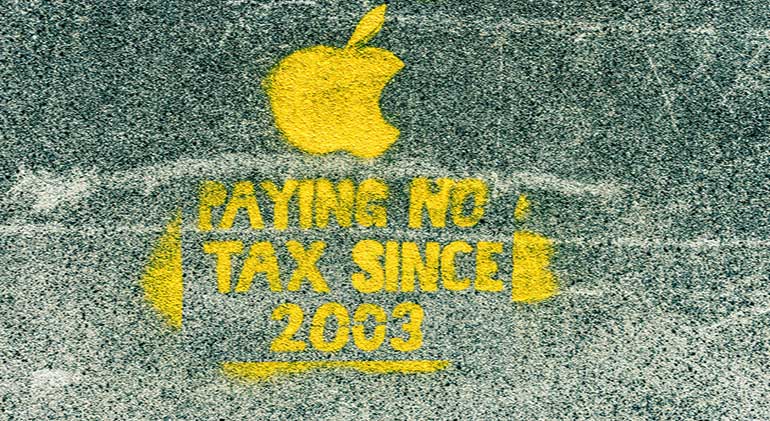

General Court brings the curtain down on epic court battle between Apple Ireland and the EU/European Commission in a state aid case labelled the ‘Apple Tax case’. On July 15, 2020, the EU’s General Court overturned the Commission’s decision because the Commission failed to prove Apple had broken competition rules. Following an in-depth state aid investigation launched in June 2014, the Commission requested information on any rulings granted by Ireland in favour of the Apple Group companies: Apple Operations International (AOI), Apple Sales International (ASI) and Apple Operations Europe (AOE). The Commission concluded that two tax rulings issued by Ireland to […]

Details

One learns early on – if you want to sit at the cool kids’ table, you must do the work and engage in tedious diplomatic battles and quid pro quo bargains. Yet, does the accession to the EU automatically erase ghosts of times past? If one looks at the love-hate triangle between the EU, Romania and the Micula brothers, the answer is not necessarily positive. The Micula phenomenon No international lawyer is likely to ever ask: “Micula – who?” On the contrary, the Micula case(s) have by now generated such notoriety that they represent household terms in law offices around […]

Details

Serbia’s Parliamentary Committee on Finance, State Budget and Control of Public Spending held a public hearing yesterday, December 3, 2019. Among the items on the agenda was the shortlisting of candidates for election to the State Aid Commission’s new Council and election of the Commission’s chairperson. Incumbent chairperson of the Commission, Vladimir Antonijević, was nominated for reelection to another five years in office, whereas other nominees for Council membership include Marko Vidaković, Ljiljana Blagojević, Dragan Đurđević, and Dušica Đorđević. In the light of the recently enacted new State Aid Act, on which draft we provided proposals in the course of […]

Details

Alea iacta est! Serbia is in line for a new State Aid Control Act. Ten years ago, when enacted, the first (and still the only) act was welcomed as a long-awaited and indispensable piece of legislation. Today, and following ten-years’ implementation, we are about to get a new one. What lessons have we drawn from implementation of the current act (apart from the fact that we need a new one)? The reasons for adopting a new act, according to its drafters, are as follows: Harmonization with the EU acquis – Well, that’s a turn-up for the books! Can you think […]

Details

Gecić Law has successfully advised the Republic of Serbia and EPS, one of the largest energy companies in the region, in a probe led by Energy Community Secretariat regarding alleged State support for the multi-million-euro Kolubara B project. On Monday, June 25, 2018, the Energy Community Secretariat announced the parties reached an amicable solution bringing the two-year long case to an end. The Kolubara B power plant project will enable EPS to add 700 MW of electricity annually, constituting the most important investment in the Serbian energy infrastructure in the last four decades. The ruling not only confirmed our team’s […]

Details

Gecić Law acted as legal counsel to the Government of Serbia and the Železara Smederevo steel mill with respect to an European Commission (EC) investigation on the historical State aid received by the old company, and the potential responsibility of Hesteel Serbia to reimburse it, under the Stabilisation and Association Agreement (SAA). On Wednesday, November 8, 2017, Johannes Hahn, Commissioner for European Neighborhood Policy and Enlargement Negotiations, informed the Prime Minister of the Republic of Serbia, Ana Brnabić, that the European Commission concluded that “the HeSteel-owned steel mill does not have to reimburse any state aid received in the past” (link). […]

Details

Both Serbia and Montenegro have come under pressure from the European Commission to amend their respective Corporate Profit Tax Acts to bring tax incentives in line with EU law. This update provides a closer look and analysis, which suggests that amendments are an option worth considering for both Serbia and Montenegro. However, any such legislative change would need to be implemented in a manner that takes into account the interests of all stakeholders, including the interests of investors benefiting from the existing incentive schemes. The European Commission in Chapter 8 of its Screening Report for Serbia, emphasized that specific aid […]

Details

McDonald’s might be the next company facing the obligation to pay back taxes, only this time to Luxembourg, in the amount of approximately $500 million, according to Financial Times estimates. In December 2015, the European Commission has opened a formal investigation of Luxembourg’s tax treatment in case of McDonald’s. It held a preliminary view that “a tax ruling granted by Luxembourg may have granted McDonald’s an advantageous tax treatment in breach of EU State aid rules.”1 The Commission is yet to render a decision that would conclude said formal investigation against American fast food giant and contain its final judgment […]

Details

Gecić | Law advised Železara Smederevo and the Government of Serbia on EU, regulatory and corporate matters in connection with the €46 million ($52 million) sale of assets of Železara Smederevo’s through a public tender procedure to the Chinese company Hebei Iron and Steel Company Limited (HBIS). Under the transaction, HBIS pledged to invest at least $300 million in a new company and to utilize the acquired assets to develop its global layout and to provide better service for its customers in Europe. Leading Serbian Steel Manufacturer Železara Smederevo is Serbia’s leading producer of steel and is the second-largest Serbian […]

Details

On 12 December 2015, the Serbian Parliament enacted the amendments to the Act on Incentives in Agriculture and Rural Development. The law was promulgated on 22 December and will be enforced as of 1 January 2016. Before we review the changes the Act on Incentives in Agriculture and Rural Development introduces, we will address the burning issue that all beneficiaries of agricultural subsidies might feel threatened by – whether these subsidies are currently caught by state aid rules (the “State Aid Act”) leaving beneficiaries open to potential recovery claims from the State Aid Authority? Тhe purpose of the Act on Incentives in […]

Details