Some reports say that it would be impossible to live in the digital world outside of the ecosystem created by Big Tech giants. The concentration of power in a small number of platforms has allowed some tech companies, popularly known as the Four Horsemen” to exercise unparalleled economic power and social impact almost without any oversight by regulators. These companies have complete market dominance, each in their respective field of expertise: Apple in consumer electronics and mobile operating systems; Facebook in the social media, Google in online searches, video-sharing and mapping-based navigation; and, finally, Amazon in the e-commerce market. Hence, […]

Details

Everyday life in the 21st century is awash with change, change mostly dictated by modern technologies and their constant evolution. Mobile payment apps are the latest (and most innovative) addition to the stable of convenience services, allowing users to pay quickly and securely. The COVID-19 pandemic has pressed home the advantages of paying through mobile phone apps, considering that this method of payment minimizes physical contact between merchants and customers, Apple Pay, a mobile payment application, was launched in Serbia at the end of June 2020. We spoke with Nikola Mehandžić, Business Development Director for the Western Balkans at MasterCard, […]

Details

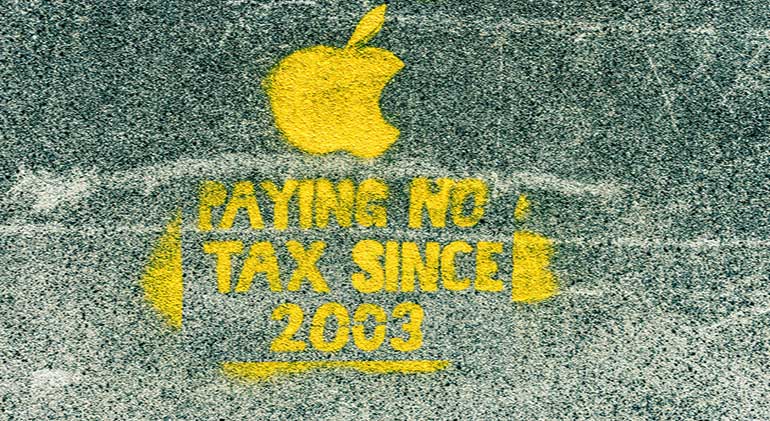

General Court brings the curtain down on epic court battle between Apple Ireland and the EU/European Commission in a state aid case labelled the ‘Apple Tax case’. On July 15, 2020, the EU’s General Court overturned the Commission’s decision because the Commission failed to prove Apple had broken competition rules. Following an in-depth state aid investigation launched in June 2014, the Commission requested information on any rulings granted by Ireland in favour of the Apple Group companies: Apple Operations International (AOI), Apple Sales International (ASI) and Apple Operations Europe (AOE). The Commission concluded that two tax rulings issued by Ireland to […]

Details

McDonald’s might be the next company facing the obligation to pay back taxes, only this time to Luxembourg, in the amount of approximately $500 million, according to Financial Times estimates. In December 2015, the European Commission has opened a formal investigation of Luxembourg’s tax treatment in case of McDonald’s. It held a preliminary view that “a tax ruling granted by Luxembourg may have granted McDonald’s an advantageous tax treatment in breach of EU State aid rules.”1 The Commission is yet to render a decision that would conclude said formal investigation against American fast food giant and contain its final judgment […]

Details

“The European Commission has concluded that Ireland granted undue tax benefits of up to €13 billion to Apple [the biggest tax bill ever imposed outside the US]. This is illegal under EU state aid rules, because it allowed Apple to pay substantially less tax than other businesses. Ireland must now recover the illegal aid [indirect subsidies].“1 Following an in-depth state aid investigation of the “sweetheart fiscal deal” between Ireland and Apple, the European Commission has concluded that Apple received illegal tax benefits from Ireland through a favorable tax arrangement selectively provided to this company for a number of consecutive years. […]

Details